Lagos stands as Africa’s most dynamic real estate market, offering unparalleled opportunities for those looking to invest in land in Nigeria. With its rapidly expanding population projected to exceed 20 million by 2025 and a housing deficit expected to reach 3 million units, Lagos presents a compelling case for strategic property investment. This comprehensive guide will equip you with essential insights, market forecasts, and optimization strategies to maximize your returns when you invest in buildings in Nigeria.

Key Market Trends Shaping Lagos Real Estate in 2025

Emerging Neighborhoods: The New Frontier for High Returns

While premium locations like Ikoyi and Victoria Island have seen property prices skyrocket—with land prices in Ikoyi surging 113% between 2021 and 2023—emerging neighborhoods offer more accessible entry points with exceptional growth potential. These areas represent the future of real estate investment Nigeria, driven by strong demand for affordable housing from the growing population.

The transformation of areas like Banana Island from emerging districts to luxury destinations demonstrates the remarkable potential of strategic location selection. Government initiatives such as the Lagos Smart City project are systematically improving infrastructure, making these previously overlooked areas increasingly attractive to investors seeking to invest in land in Nigeria.

Key opportunities in emerging neighborhoods include:

- Higher potential rental yields due to lower initial investment costs

- Significant capital appreciation as infrastructure develops

- Strong demand from Lagos’s expanding middle class

- Government-backed urban development projects enhancing property values

The Luxury Market: Increased Foreign Interest with Price Stabilization

Foreign investment in Lagos’s luxury real estate sector continues to surge, driven by increased foreign direct investment (FDI) and the influx of multinational corporations attracting expatriate professionals. Nigeria’s economic growth projections are drawing international investors seeking to invest in buildings in Nigeria, particularly in the high-end segment.

Victoria Island remains the epicenter for affluent buyers, with apartment prices ranging from ₦1.5 million to ₦5 million per square meter in 2024. However, increased competition and new real estate developments are expected to stabilize luxury property prices, creating more balanced market conditions for investors.

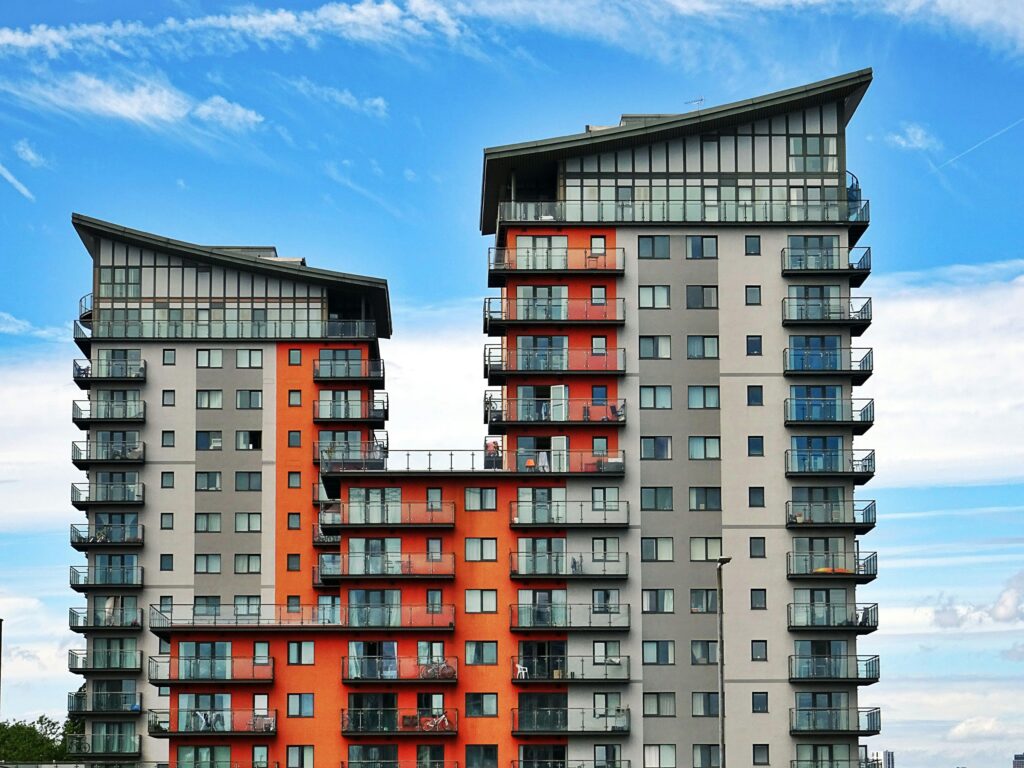

High-Rise Development: Addressing Land Scarcity

The rapid population growth and limited undeveloped land in central Lagos have necessitated a shift toward vertical development. Government policies actively encourage high-rise construction to optimize land use efficiency, making this a practical solution for accommodating the growing population.

For investors, high-rise developments represent an opportunity to maximize returns from limited land resources while contributing to Lagos’s urban transformation. This trend is particularly significant for those seeking to invest in land in Nigeria with development potential.

Affordable Housing Segment and Rental Yields

The soaring demand for housing, especially affordable options, is driving rental yield increases across Lagos. This trend makes the affordable housing segment potentially lucrative for investors focused on real estate investment Nigeria. Average rental prices for apartments in Lagos have grown 5-7% annually, reflecting the strong underlying demand.

The limited purchasing power of many Lagos residents, combined with rapid urbanization, ensures sustained demand for rental properties. This creates excellent opportunities for investors targeting the rental market segment.

Middle-Class Growth and Mid-Range Real Estate

Nigeria’s rapidly expanding middle class is fueling demand for mid-range housing solutions. Market forecasts indicate that average property prices in Lagos could reach approximately ₦50 million by 2025, reflecting the growing purchasing power of this demographic.

This segment offers balanced risk-reward profiles for investors, with steady appreciation potential and consistent rental demand from middle-class professionals and families.

Urban Renewal Projects: The Mushin Example

Large-scale urban renewal initiatives, such as those undertaken by the Lagos State Urban Renewal Agency (LASURA) in Mushin, are transforming previously neglected areas into attractive investment destinations. These projects focus on slum reduction and infrastructure improvement, significantly enhancing property values in targeted neighborhoods.

Urban renewal projects typically improve connectivity, accessibility, and overall livability, making them excellent opportunities for forward-thinking investors to invest in land in Nigeria before widespread development occurs.

Strategic Real Estate Investment Types for Lagos 2025

Rental Properties: Steady Income Generation

With approximately 75% of Lagos residents renting their homes, rental properties offer stable income streams combined with long-term capital appreciation. Success in this segment requires careful location selection and understanding of local rental market dynamics.

Key advantages include:

- Consistent monthly income flow

- Long-term property appreciation

- Potential tax benefits

- Portfolio diversification

The critical success factor remains purchasing or building in prime locations with strong rental demand and good infrastructure connectivity.

Real Estate Development: High-Value Creation

Real estate development contributes significantly to Lagos’s ₦2.26 billion property sector value, offering opportunities to address the housing deficit while generating substantial returns. However, development projects require significant capital investment and often necessitate external financing.

Development opportunities include:

- Residential complexes targeting middle-income buyers

- Mixed-use developments combining commercial and residential spaces

- Affordable housing projects supported by government initiatives

- Luxury developments in premium locations

Land Banking: Strategic Long-Term Investment

Land banking involves purchasing land in strategic or developing areas for future resale at higher prices. This approach offers security and appreciation potential with minimal maintenance costs, making it attractive for investors focused on long-term wealth building.

Considerations for land banking include:

- Lower immediate cash flow compared to rental properties

- Longer appreciation periods requiring patience

- Potential liquidity challenges

- Importance of location selection and timing

Fix and Flip: Quick Turnaround Profits

The fix-and-flip strategy involves purchasing older buildings, renovating them, and reselling at higher prices. This approach offers high profit margins and quick turnaround times with lower initial capital requirements compared to full development projects.

Success factors include:

- Accurate property valuation and renovation cost estimation

- Understanding of local buyer preferences

- Efficient project management and contractor relationships

- Market timing for optimal resale conditions

Real Estate Investment Trusts (REITs): Accessible Diversification

REITs provide opportunities to invest in buildings in Nigeria without direct property ownership, offering liquidity, professional management, and portfolio diversification. Nigerian REITs include equity, mortgage, and hybrid types, each with distinct risk-return profiles.

Benefits of REIT investments include:

- Lower minimum investment requirements

- Professional property management

- Regular dividend payments

- Portfolio diversification across multiple properties

- Liquidity through stock exchange trading

Essential Steps for Successful Lagos Real Estate Investment

Comprehensive Market Analysis

Thorough market analysis forms the foundation of successful real estate investment Nigeria. This involves understanding local trends, demand patterns, competition, and regulatory environments. Engaging experienced market experts and industry veterans provides valuable insights for informed decision-making.

Critical analysis areas include:

- Demographic trends and population growth patterns

- Infrastructure development plans and timelines

- Economic indicators affecting property demand

- Competitive landscape and pricing trends

- Regulatory changes and their implications

SMART Investment Goal Setting

Defining clear, SMART (Specific, Measurable, Achievable, Relevant, Time-bound) investment objectives ensures focused strategy implementation. Common goals include income generation, capital appreciation, portfolio diversification, tax benefits, and social impact creation.

Effective goal setting involves:

- Quantifying expected returns and timelines

- Identifying specific property types and locations

- Establishing budget parameters and financing strategies

- Defining exit strategies for different scenarios

- Setting performance measurement criteria

Thorough Due Diligence

Comprehensive due diligence prevents legal issues and financial losses by verifying property legitimacy, valuation accuracy, zoning compliance, environmental assessments, road networks, and utility access. This critical step protects investors from common pitfalls in the Nigerian real estate market.

Due diligence checklist includes:

- Property title verification and ownership documentation

- Land use regulations and zoning compliance

- Environmental impact assessments

- Infrastructure and utility availability

- Legal encumbrances and liens

- Market comparables and valuation verification

Investment Financing Strategy

Financing options for Lagos real estate investments include self-funding, bank loans, co-investors, crowdfunding, and developer partnerships. Each option carries different implications for ownership, control, and returns, requiring careful evaluation of long-term consequences.

Financing considerations include:

- Interest rates and loan terms

- Down payment requirements

- Partnership structures and profit sharing

- Collateral requirements and personal guarantees

- Repayment schedules and cash flow implications

- Exit strategy flexibility under different financing structures

Professional Advisory Services

Engaging qualified professionals minimizes investment risks and maximizes success probability. Key advisors include real estate agents, lawyers, financial advisors, and surveyors, each bringing specialized expertise to the investment process.

Professional services typically include:

- Market research and property identification

- Legal documentation and contract negotiation

- Financial modeling and investment analysis

- Property inspection and valuation

- Transaction facilitation and closing management

- Ongoing portfolio management and optimization

Advanced SEO and AI Optimization Strategies

Keyword Research and Intent Optimization

Successful online visibility requires identifying high-intent, low-competition search terms used by Nigerian property investors. Tools like Google Keyword Planner, Ubersuggest, and Ahrefs provide valuable insights into search volumes and competition levels.

Effective keyword strategies include:

- Long-tail keywords targeting specific investment scenarios

- Local search optimization for Lagos-specific terms

- Intent-based content matching informational, commercial, and transactional searches

- Semantic keyword integration for natural language processing

- Competitive analysis and gap identification

High-Quality Content Creation (E-E-A-T)

Google rewards content demonstrating Experience, Expertise, Authoritativeness, and Trustworthiness. Creating valuable, engaging content that genuinely helps users requires avoiding jargon while providing concrete examples and actionable insights.

Content optimization principles include:

- Clear, structured formatting with appropriate headers

- Direct answers to common investor questions

- Expert insights and market data integration

- User-focused language and practical guidance

- Regular content updates reflecting market changes

Technical SEO Implementation

Technical SEO ensures search engines can effectively crawl, index, and rank your content. This includes optimizing site speed, mobile responsiveness, HTTPS implementation, XML sitemaps, and fixing broken links.

Critical technical elements include:

- Fast loading times across all devices

- Mobile-first design and functionality

- Secure HTTPS protocol implementation

- Proper URL structure and internal linking

- Image optimization and alt text

- Schema markup for enhanced search results

Link Building and Authority Development

Building domain authority through quality backlinks from reputable sources strengthens search engine rankings. This involves creating valuable content that naturally attracts links while strategically pursuing partnerships with industry publications and experts.

Link building strategies include:

- Guest posting on relevant industry websites

- Creating shareable research and market reports

- Building relationships with local real estate professionals

- Participating in industry forums and discussions

- Developing linkable assets like calculators and guides

Conclusion: Transforming Lagos Real Estate Opportunities into Profits

Lagos represents Africa’s most dynamic real estate market, offering diverse investment opportunities for those willing to invest in land in Nigeria or invest in buildings in Nigeria. Success requires comprehensive market research, strategic planning, and professional guidance to navigate this complex but rewarding market.

The key to successful real estate investment Nigeria lies in understanding local market dynamics, maintaining realistic expectations, and adapting strategies to changing conditions. Whether pursuing rental properties, development projects, land banking, or REIT investments, Lagos offers pathways to significant returns for well-informed investors.

Ready to transform these market insights into profitable investments? Contact our Lagos real estate experts today for personalized consultation and professional guidance on your next property investment project. Our experienced team can help you identify opportunities, navigate regulatory requirements, and maximize your investment returns in Nigeria’s most promising real estate market.